The FinCEN Anti-Money Laundering and Sanctions Whistleblower Program

What is the FinCEN Whistleblower Program?

The Anti-Money Laundering Act of 2020 created a whistleblower program within the Treasury Department modeled after the SEC and CFTC’s highly successful whistleblower programs. The Treasury’s Financial Crimes Enforcement Network (FinCEN) bureau is administering the program.

The Anti-Money Laundering and Sanctions Whistleblower Program is focused on exposing two broad categories of misconduct: (a) violations of the Bank Secrecy Act (the United States’ key anti-money laundering law); and (b) violations of certain designated sanctions laws (and conspiracies to violate the BSA and operative sanctions laws laws). The program covers violations of the following sanctions laws:

- International Emergency Economic Powers Act (50 U.S.C. § 1701 et seq.)

- Trading with the Enemy Act (50 U.S.C. §§ 4305, 4312)

- Foreign Narcotics Kingpin Designation Act (21 U.S.C. § 1901 et seq.)

How Does the FinCEN Anti-Money Laundering and Sanctions Whistleblower Work?

FinCEN’s AML and Sanctions Whistleblower Program operates in a similar manner to the SEC’s whistleblower program. A whistleblower must voluntarily provide “original information” to the Treasury Secretary, the Attorney General, or his or her employer regarding covered legal violations (e.g., a violation of the Bank Secrecy Act). The Treasury (or some other arm of the government) may then investigate the allegations made by the whistleblower. If the whistleblower’s information leads to a covered enforcement action (e.g., an action by FinCEN) and results in monetary sanctions exceeding $1,000,000, then the whistleblower (or whistleblowers, if there are more than one) must be awarded between 10% and 30% of the monetary sanctions collected. That percentage may be lower if the whistleblower is also due an award under another whistleblower program (e.g., if the whistleblower is eligible for awards under the Treasury and SEC whistleblower programs).

Can Whistleblowers Obtain an Award if They Submit a Tip Even While an Investigation is Already in Progress?

The underlying statute establishes that the whistleblower’s original information must have “led to” a successful enforcement action. The Treasury Department has yet to offer any guidance interpreting that provision but similar whistleblower statutes (e.g., that establishing the SEC whistleblower program) have been interpreted to provide for awards to whistleblowers who submit information during an ongoing investigation if the whistleblower’s information “significantly contributes” to the government’s success. The Treasury Department program will very likely follow that standard – meaning that even when an investigation is in progress, a whistleblower may still be able to submit a tip and obtain an award.

Do FinCEN Whistleblowers Have to be Corporate Insiders to be Eligible for an Award?

No. There is no requirement that a FinCEN whistleblower be a corporate insider. Insiders often have unique access to valuable information relating to violations of the law, but consultants, contractors, and other “outsiders” may also have access to information which may form the basis of a successful whistleblower submission.

Do FinCEN Whistleblowers Have to be U.S. Citizens?

No. FinCEN’s Anti-Money Laundering-Sanctions Whistleblower Program is open to both American citizens and foreign citizens. And that is true regardless of residence. In fact, foreign individuals may often have especially valuable information given the international scope of these laws.

Can I be a FinCEN Whistleblower if I Work in a Compliance Role?

There are no statutory limitations on whistleblowers who work in compliance or similar roles. Thus, by law, compliance personnel may blow the whistle and seek an award under the Anti-Money Laundering and Sanctions Whistleblower Program. Compliance personnel are often ideal whistleblowers because their jobs provide them significant insight into legal violations.

Can a FinCEN Whistleblower Submit a Tip Anonymously?

A whistleblower can submit a tip anonymously while remaining eligible for a whistleblower award, but only if he or she is represented by counsel. However, before the payment of an award, the whistleblower must identify himself or herself to the government.

What Types of Companies are Covered by the Bank Secrecy Act?

The BSA’s anti-money laundering laws and regulations apply to a wide range of financial institutions, including:

- Banks

- Currency Exchanges (including Cryptocurrency Exchanges)

- Credit Unions

- Broker-Dealers

- Credit Card System Operators

- Mutual Funds

- Insurance Companies

- Check Cashers

- Money Transmitters

- Certain Casinos

- Fintech Companies

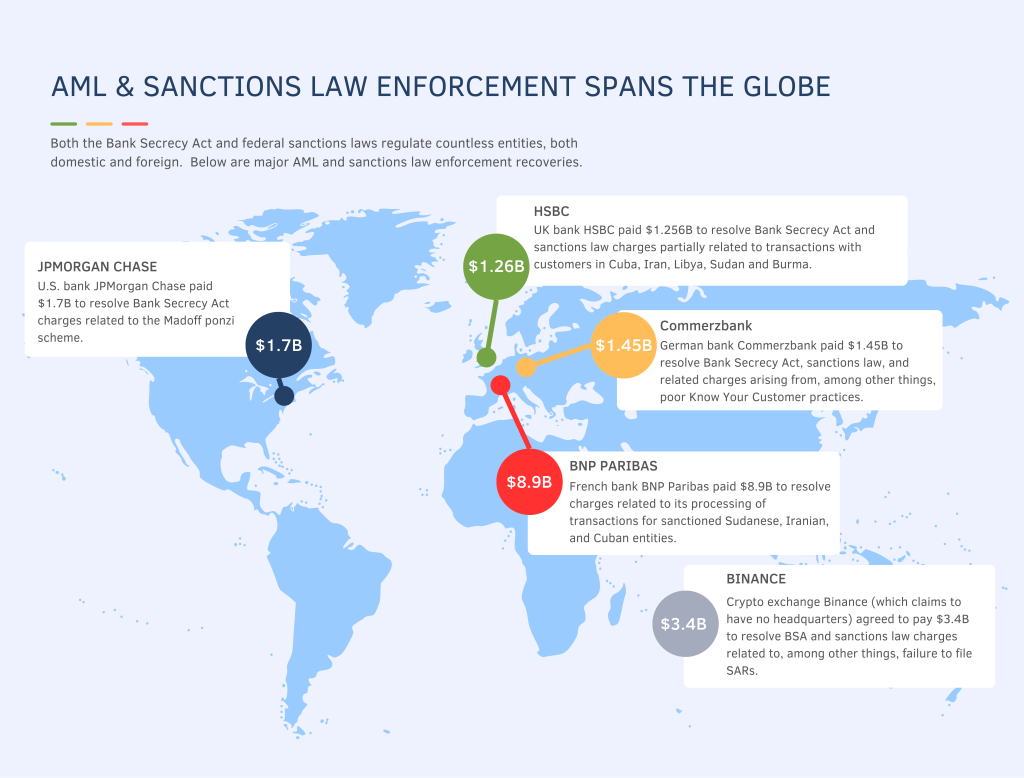

Both domestic and foreign companies can be subject to (and run afoul of) the Bank Secrecy Act – and the same is true for violations of the sanctions laws. Because these cases often involve systemic failures at deep-pocketed institutions, Bank Secrecy Act and sanctions law recoveries can rise to the billions of dollars. This gives whistleblowers plenty of financial incentive to come forward with valuable information and seek an award. A large recovery means the potential for a large award.

What Legal Obligations Do Covered Entities have under the Bank Secrecy Act?

The Bank Secrecy Act and its attendant regulations impose extensive anti-money laundering obligations on covered entities. For example, financial institutions must file reports for clients that engage in cash transactions exceeding $10,000 per day (i.e., Currency Transaction Reports); file Suspicious Activity Reports for transactions which may reflect money laundering, tax evasion, etc.; and employ adequate Know Your Customer (“KYC”) protocols.

The BSA’s anti-money laundering requirement establish what are often referred to as the five key pillars of an AML compliance program.

Entities which fail to abide by the BSA’s requirements can face massive government sanctions.

What Types of Conduct can Run Afoul of the Sanctions Laws?

The Treasury’s whistleblower program covers three key federal sanctions statutes. Sanctions law violations can take many forms. One doing business with a sanctioned entity may run afoul of these laws. Further, a company that allows another to transact business with a sanctioned entity (e.g., facilitates such illegal business) may also violate the law.

Which Agencies Investigate Whistleblower Tips under FinCEN’s Anti-Money Laundering and Sanctions Whistleblower Program?

Within the Treasury Department, FinCEN typically investigates violations of the Bank Secrecy Act. The Treasury Department’s Office of Foreign Assets Control (OFAC) generally investigates and enforces the sanctions laws. The Department of Justice and other federal and state agencies may also be involved.

Can Anti-Money Laundering and Sanctions Whistleblowers Use an Attorney?

Yes. Anti-money laundering and sanctions whistleblowers can and should employ capable counsel. Experienced whistleblower attorneys can prepare the submission to, and interact with, the Treasury and other regulators, which can increase the odds that the government pursues the case. Given the complex nature of the laws and related violations, whistleblower attorneys can ensure that the whistleblower’s information is presented to the government in a compelling manner that shows how the laws have been violated. Counsel can take steps to ensure that the whistleblower’s information is submitted in a procedurally and substantively appropriate manner that avoids technical missteps and later advocate for the client during the award process. And use of an attorney can maximize anonymity protections.

Whistleblower attorneys can work to reduce the risk of retaliation too, and, if retaliation occurs, obtain relief under the anti-retaliation provisions of the whistleblower law.

Pietragallo Gordon Alfano Bosick & Raspanti LLP has represented whistleblowers for over three decades and knows how to present whistleblower tips in a compelling and effective manner. Further, we can advocate on your behalf throughout the investigation process and zealously pursue any monetary awards should the tip result in an eligible resolution. If you are interested in pursuing an Anti-Money Laundering and Sanctions Whistleblower Program claim, we would be pleased to speak with you. We do not charge any fee for an initial consultation.

Do Whistleblowers Receive Protection from Retaliation under FinCEN’s Ant-Money Laundering and Sanctions Whistleblower Program?

Yes. The Anti-Money Laundering Whistleblower Act (AMLA) generally bars employers from retaliating against a whistleblower for a wide range of acts covered by the AML and Sanctions Whistleblower Program (e.g., reporting misconduct to various federal entities). The AMLA’s retaliation provisions, however, do not apply to employers subject to section 33 of the Federal Deposit Insurance Act or section 213 or 214 of the Federal Credit Union Act given that such employers are already governed by separate whistleblower anti-relation laws.

A whistleblower subject to retaliation under AMLA must timely file a retaliation complaint with the Department of Labor. If the DOL has not issued a final decision within 180 days of the whistleblower’s retaliation complaint, the whistleblower can typically file a lawsuit in court to pursue the claim. One subject to retaliation can seek reinstatement, double backpay, compensatory damages, attorney’s fees and costs, and other appropriate relief.

Is the Identity of an Anti-Money Laundering and Sanctions Whistleblower Kept Anonymous?

Under the AMLA law, the Treasury and Department of Justice may not (subject to certain narrow exceptions) disclose any information “which could reasonably be expected to reveal the identity of a whistleblower.” That ensures that the odds that a whistleblower will be outed by the government remain very low.